Child Tax Credit 2024 Monthly Payments Amounts – The proposed deal would increase the maximum refundable amount per child to $1,800 in tax year 2023, $1,900 in tax year 2024, and $2,000 in tax year 2025. Additionally, the maximum $2,000 child tax . Here’s how a proposed change in the rules for the child tax credit impact tax refunds and the upcoming tax season. .

Child Tax Credit 2024 Monthly Payments Amounts

Source : matricbseb.com

The American Families Plan: Too many tax credits for children

Source : www.brookings.edu

$300/Month Child Tax Credit Increase in United States, How to know

Source : www.wbhrb.in

Child Tax Credit Definition: How It Works and How to Claim It

Source : www.investopedia.com

IRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.com

Child Tax Credit 2023 2024: Requirements, How to Claim NerdWallet

Source : www.nerdwallet.com

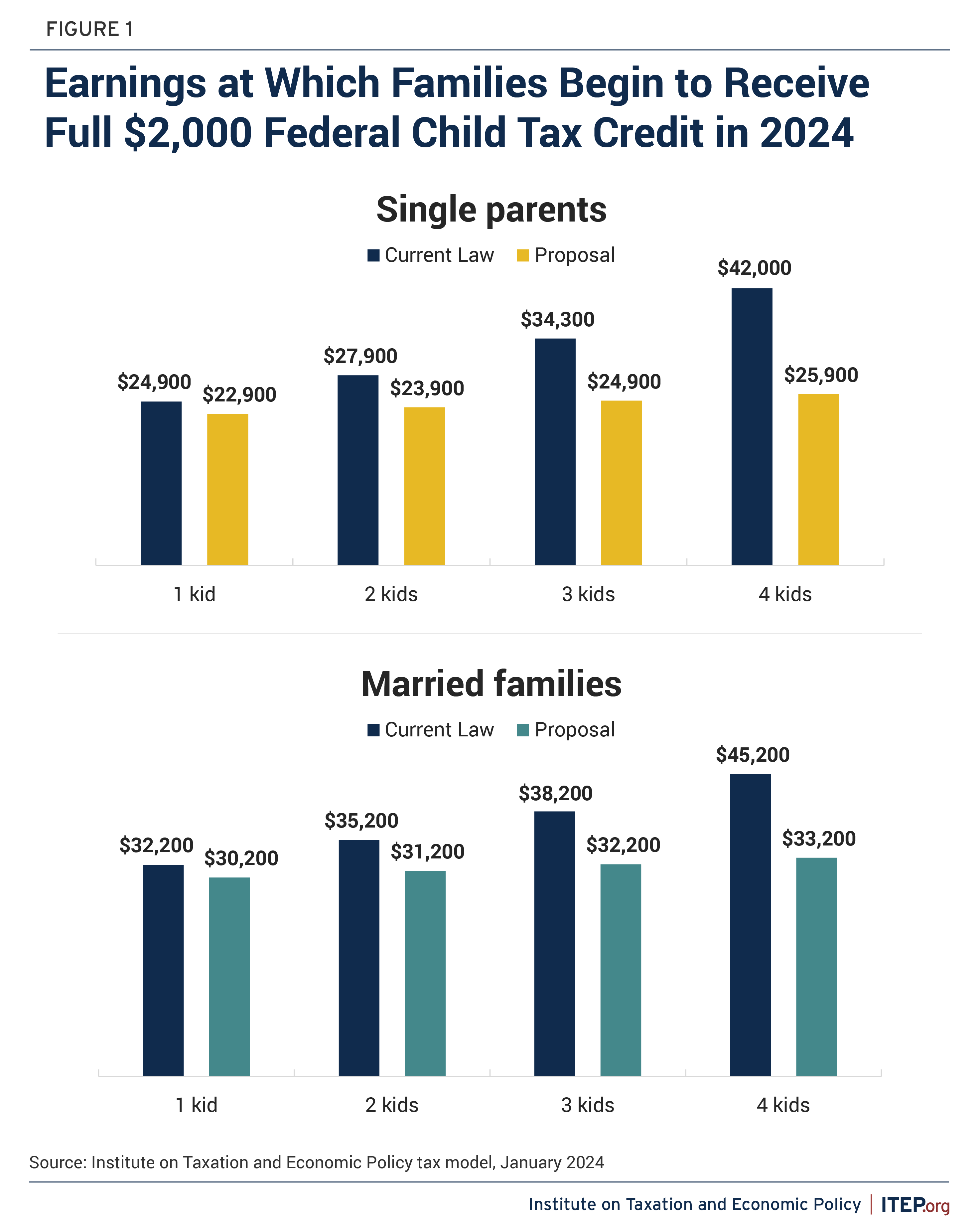

Proposed Tax Deal Would Help Millions of Kids with Child Tax

Source : itep.org

Child Tax Credit 2024 Income Limits: What is the income limits for

Source : www.marca.com

2023 2024 Child Tax Credit: What Will You Receive? | SmartAsset

Source : smartasset.com

Bipartisan deal to expand child tax credit, revive business tax

Source : nebraskaexaminer.com

Child Tax Credit 2024 Monthly Payments Amounts Child Tax Credit 2024 Apply Online, Eligibility Criteria : The child tax credit stands as a significant federal tax benefit designed to offer financial support to American taxpayers raising children. This credit allows for a tax credit of . The temporary 2021 expanded child tax credit helped millions out of poverty. A new bill will enhance the tax credit, although experts say it will have trouble passing Congress. .

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-1-7dd01914195e4ab2bc05ae78a40f8f0c.jpg)