Child Tax Credit 2024 Eligibility Requirements Schedule – People filing in 2024 are filing for the year 2023. The Child Tax Credit offers support to as many as 48 million applying American adults who need an extra bit of help with raising their children so . For the 2024 tax year, the child tax credit remains at up to $2,000, but the refundable portion of the credit increases to $1,700. This means eligible IRS has strict guidelines for which .

Child Tax Credit 2024 Eligibility Requirements Schedule

Source : www.kvguruji.com

Child Tax Credit Definition: How It Works and How to Claim It

Source : www.investopedia.com

Child Tax Credit 2024 Apply Online, Eligibility Criteria

Source : matricbseb.com

Child Tax Credit 2024: Eligibility Criteria, Apply Online, Monthly

Source : ncblpc.org

2023 and 2024 Child Tax Credit: Top 7 Requirements TurboTax Tax

Source : turbotax.intuit.com

Earned Income Tax Credit 2024 Eligibility, Amount & How to claim

Source : www.bscnursing2022.com

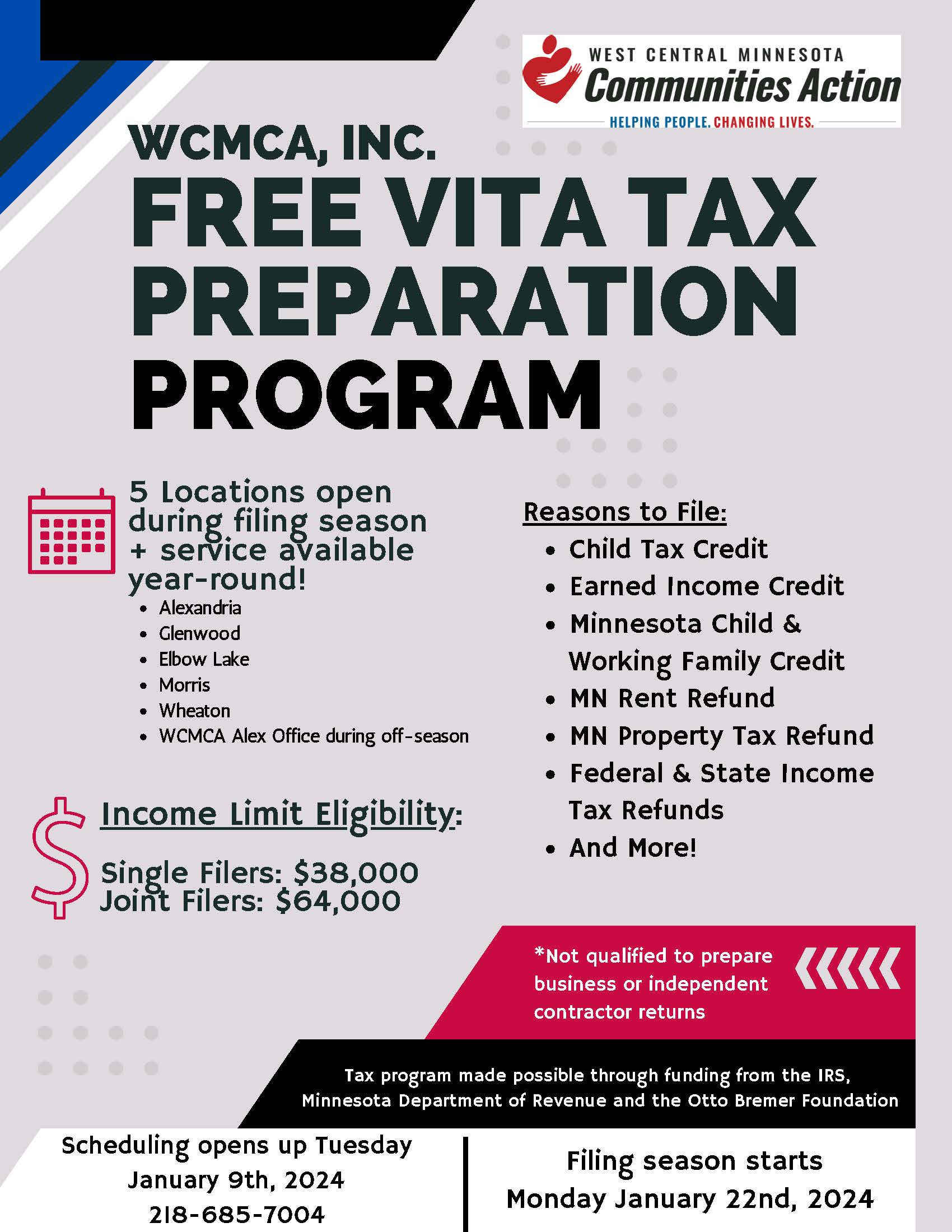

Free Tax Preparation West Central Minnesota Communities Action, Inc.

Source : wcmca.org

2023 and 2024 Child Tax Credit TurboTax Tax Tips & Videos

Source : turbotax.intuit.com

Child Tax Credit 2024 Eligibility: Can you get the child tax

Source : www.marca.com

Child Tax Credit 2023 2024: Requirements, How to Claim NerdWallet

Source : www.nerdwallet.com

Child Tax Credit 2024 Eligibility Requirements Schedule IRS Child Tax Credit 2024: Credit Amount, Payment Schedule, Tax Return: To be eligible dollars in tax relief for New Mexicans, including: In New York, those who meet certain income and residency requirements can claim the Empire State child credit. . There are several requirements to qualify. The first is you must be a parent or guardian who is filing taxes in 2024 a schedule 8812, which is or credits for qualifying children and .

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-1-7dd01914195e4ab2bc05ae78a40f8f0c.jpg)